In the first quarter of 2021, luxury chain-affiliated hotels in the U.S. reported average daily rate growth of 3.4% compared to the first quarter of 2020. In other words, those types of rooms were a little more expensive than they were a year ago.

This is noteworthy since room rates declined for all other chain scales in the first three months of the year. It is also worth noting that the first two months of 2020 were not affected by the pandemic, so room rate performance during those months was still strong. Being able to increase the average daily rate, or ADR, on top of the “normal” performance from a year ago speaks to the pricing power that high-end hotel operators can summon.

Granted, only a third of luxury rooms were occupied, the lowest occupancy of all scales. But it seems that hoteliers and revenue managers on the very high end are once again able to command premium rates for premium rooms.

During the summer of 2020, room rates declined across all classes and most markets in the U.S. as corporate transient and group travelers stayed home and leisure travelers were the only group consistently traveling. But for luxury hotels, the lack of corporate, pre-negotiated rates meant that the mix of room rates shifted up since leisure travelers often pay for higher-end rooms.

One word of caution when estimating luxury-scale ADRs going forward: If corporate demand increases as expected in late 2021 and beyond, the ADR increases will likely soften since the customer mix, and hence the ADR mix, will revert to prior averages and we can expect the luxury ADR will not grow as quickly.

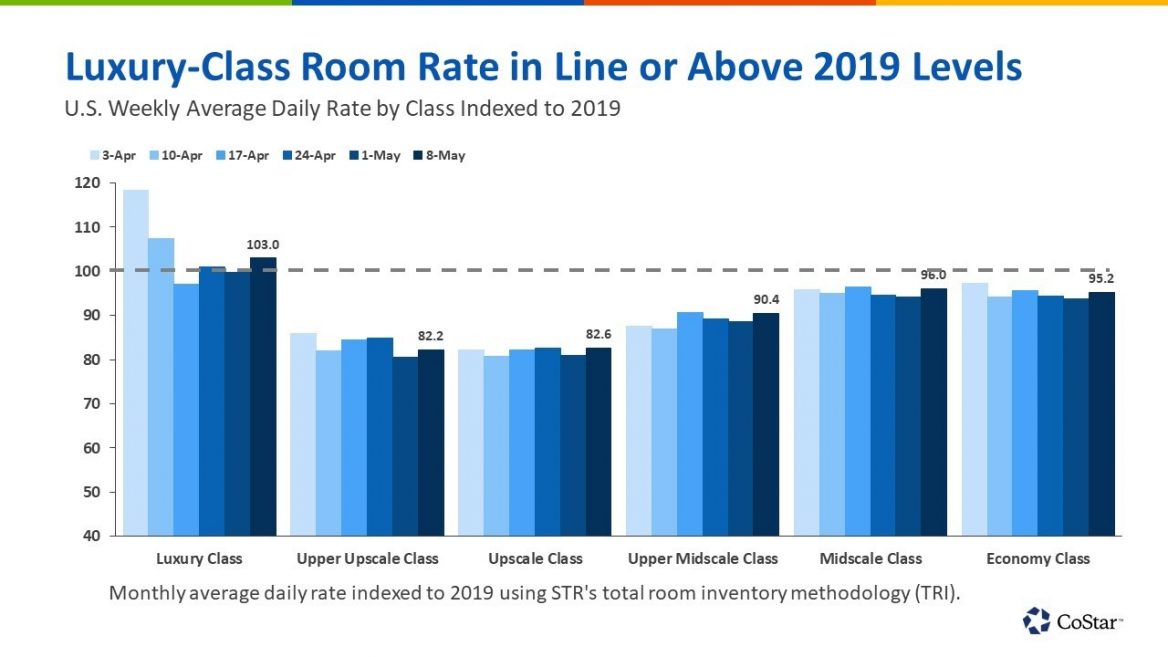

The weekly data including spring break weeks in late April shows similar results.

Lower-end room rates, which in absolute dollar terms did not fall as severely in 2020, are also well on their way to recovery compared to 2019. But for the week of May 8, luxury-class ADR has fully recovered.

Luxury Hotel Deals Pick Back Up

The healthy leisure demand, coupled with the return of pricing power for luxury hotels, has led to at least some deals in which buyers and sellers seem to agree that the “annus horribilis” of 2020 is firmly in the rearview mirror and the asset values of luxury hotels are not depressed. Two recent transactions point at this reality.

In April, the 130-room Montage Healdburg north of San Francisco sold in an off-market transaction to Sunstone Hotel Investors for over $2 million per key. The property is fairly new, having opened in December.

On the other side of the country, the 444-room Four Seasons Resort Orlando at Walt Disney World sold to Host Hotels & Resorts for $610 million in early May. Host Hotels stated in a press release that the purchase price equated to a 4.7% capitalization rate on 2019 results. This can be interpreted as a sign that buyers and sellers agreed on the positive outlook for a high-end property that can attract a mix of luxury, leisure and corporate group demand.

Taken together, the ongoing pricing trends plus the availability of capital for high-end assets bodes well for the luxury end of the hotel industry.

For more information about New Jersey or Philadelphia hotel property, New Jersey or Philadelphia industrial space, New Jersey or Philadelphia retail space, and New Jersey or Philadelphia office space or other New Jersey and Philadelphia commercial properties, please call 856-857-6300 to speak with Jason Wolf (jason.wolf@wolfcre.com) at Wolf Commercial Real Estate, a leading New Jersey and Philadelphia commercial real estate broker that specializes in both New Jersey and Philadelphia office space, New Jersey and Philadelphia retail space, New Jersey or Philadelphia hotel property, and New Jersey and Philadelphia industrial space.

Wolf Commercial Real Estate, a full-service CORFAC International brokerage, and advisory firm, is a premier New Jersey and Philadelphia commercial real estate brokerage firm that provides a full range of New Jersey and Philadelphia commercial real estate listings and services, property management services, and marketing commercial offices, medical properties, industrial properties, land properties, retail buildings and other New Jersey and Philadelphia commercial properties for buyers, tenants, investors, and sellers.

A New Jersey and Philadelphia commercial real estate broker with expertise in New Jersey and Philadelphia commercial real estate listings, Wolf Commercial Real Estate provides unparalleled expertise in matching companies and individuals seeking new New Jersey and Philadelphia office space, New Jersey and Philadelphia retail space, or New Jersey and Philadelphia industrial space with the New Jersey and Philadelphia commercial properties that best meets their needs.

As experts in both Philadelphia and New Jersey commercial real estate listings and services, the team at our commercial real estate brokerage firm provides ongoing detailed information about Philadelphia and New Jersey commercial properties to our clients and prospects to help them achieve their real estate goals. If you are looking for New Jersey or Philadelphia office space, Philadelphia or New Jersey retail space, or New Jersey or Philadelphia industrial space for sale or lease, Wolf Commercial Real Estate is the New Jersey and Philadelphia commercial real estate broker you need – a strategic partner who is fully invested in your long-term growth and success.

Please visit our websites for a full listing of South Jersey, Philadelphia, and New Jersey commercial properties for lease or sale through our Philadelphia commercial real estate brokerage firm.