The coronavirus spread has reintroduced factors absent from in the national and Philadelphia commercial real estate markets economy for almost a decade: widespread fear and uncertainty.

As we are early in the onset, and short on government data points collected after the virus’ spread, any market analyst in the U.S. commercial real estate market – including Philly office space, Philly retail space and Philly industrial space – worth his or her salt will admit there will be a deluge of question marks hanging over the economic outlook during the next month or two.

However, it’s still constructive to take stock of what we do know, in order to build up as clear a picture of the road ahead as possible for U.S. and Philadelphia commercial real estate listings.

This CoStar Realty Information Inc. report involving U.S. and Philadelphia commercial properties is being made available through Philadelphia commercial real estate broker Wolf Commercial Real Estate, a Philadelphia commercial real estate brokerage firm.

First off, a painful near-term decline in Philly’s economic figures in relation to national and Philadelphia commercial real estate properties is all but certain for this spring. To curb the virus’ spread and prevent hospitals from being overwhelmed with patients, Pennsylvania and New Jersey governors both ordered all nonessential businesses to close on March 16.

How long are these monumental measures likely to stay in place? China’s aggressive lockdown measures lasted about two months. The CDC recently recommended cancelling or postponing any gatherings of 50 scheduled through mid-May. Johns Hopkins University School of Medicine’s infectious disease expert Morgan Katz expects meaningful improvements by early May.

Meanwhile, Treasury Secretary Steven Mnuchin is at the center of the White House’s economic response to this crisis and says Republican senators’ proposed Coronavirus Relief Bill, now under debate in the Congress, aims to cushion businesses for 10-12 weeks of serious disruption. That would take us through early- to mid-June.

Meanwhile, Treasury Secretary Steven Mnuchin is at the center of the White House’s economic response to this crisis and says Republican senators’ proposed Coronavirus Relief Bill, now under debate in the Congress, aims to cushion businesses for 10-12 weeks of serious disruption. That would take us through early- to mid-June.

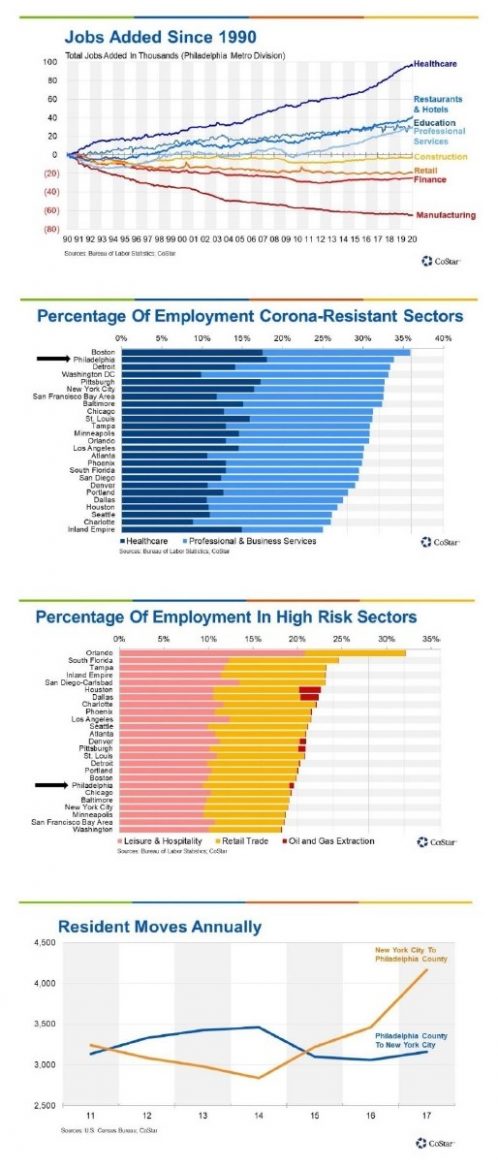

Regardless of how long these shutdowns last, the leisure/hospitality sector and retail trade sectors in the U.S. commercial real estate market – including Philly office space, Philly retail space and Philly industrial space – will likely be some of the worst-affected major industries. They represent 10 percent and 8 percent of Philadelphia total employment, respectively.

Hit by department store closures and the shift to automated or online checkout, Philadelphia’s retail employment already was on the decline before the onset of the virus. Considering how many national retailers’ balance sheets had already been eroding prior to the onset of this crisis, the road ahead looks like a painful one for the retail markets related to national and Philadelphia commercial real estate listings.

Leisure and hospitality employment, supported mostly by restaurants, bars, and hotels, had been one of the metropolitan area’s fastest-growing employment sectors. Center City’s blossoming nightlife has been a key ingredient to Philadelphia economic revival over the past 15 to 20 years. The fact that the industry is now at such high risk is probably the biggest existential threat posed by the coronavirus to Philadelphia’s ongoing revival.

But overall, the coronavirus and its accompanying economic shock do not pose major threats to the fundamental drivers of Philadelphia’s economic renaissance over the past 15 to 20 years.

Philadelphia’s industry mix positions it better than most major U.S. cities to weather the negative economic impact of the coronavirus. Very few major U.S. markets have higher concentrations of the sector including healthcare, professional and business services which will likely remain most resilient in the months ahead.

Meanwhile, Philadelphia has relatively lower concentrations of the sectors now most at risk such as leisure and hospitality, retail and oil and gas extraction.

The city’s status as a powerhouse of healthcare innovation only gains renewed importance as a result of the current tragedy and will be a key economic benefit as the number of U.S. residents aged 70 and older grows by 40 percent over the course of this new decade.

Meanwhile, the cost of living differential between Philadelphia and its nearby competitors, New York, Boston and Washington, D.C., remains massive. Philadelphia will continue to attract large net inflows of college-educated young adults moving from these places in search of more spacious housing and higher savings/disposable income.

In other words, for firms able to remain on offense during what will undoubtedly be challenging months ahead, Philadelphia remains an attractive destination for real estate investment capital seeking stable long-term growth, especially when stacked against other major metropolitan areas in the U.S. uncertainty. – By Adrian Ponsen, CoStar Analytics.

For more information about Philly office space, Philly retail space, and Philly industrial space or other Philadelphia commercial properties, please call 215-799-6900 to speak with Jason Wolf (jason.wolf@wolfcre.com) at Wolf Commercial Real Estate, a leading Philadelphia commercial real estate broker that specializes in Philly office space, Philly retail space and Philly industrial space.

Wolf Commercial Real Estate, a full-service CORFAC International brokerage and advisory firm, is a premier Philadelphia commercial real estate brokerage firm that provides a full range of Philadelphia commercial real estate listings and services, property management services, and marketing commercial offices, medical properties, industrial properties, land properties, retail buildings and other Philadelphia commercial properties for buyers, tenants, investors and sellers.

Wolf Commercial Real Estate, a Philadelphia commercial real estate broker with expertise in Philadelphia commercial real estate listings, provides unparalleled expertise in matching companies and individuals seeking new Philly office space, Philly retail space or Philly industrial space with the Philadelphia commercial properties that best meets their needs.

As experts in Philadelphia commercial real estate listings and services, the team at our Philadelphia commercial real estate brokerage firm provides ongoing detailed information about Philadelphia commercial properties to our clients and prospects to help them achieve their real estate goals. If you are looking for Philly office space, Philly retail space or Philly industrial space for sale or lease, Wolf Commercial Real Estate is the Philadelphia commercial real estate broker you need – a strategic partner who is fully invested in your long-term growth and success.

Please visit our websites for a full listing of South Jersey and Philadelphia commercial properties for lease or sale through our Philadelphia commercial real estate brokerage firm.