What is the Energy Policy Act of 2005 (EPACT) 179D and How Can It Benefit My Real Estate Portfolio? (PDF)

By Lonnie M. Barish, New Power America

The Energy Policy Act of 2005 (EPAct) was enacted creating immediate potential tax savings for building owners or architects and engineers based on the use of energy efficient improvements. Section 179D outlines the requirements for a maximum potential tax deduction of up to $1.80 per square foot of affected spaces.

WHAT TYPES OF BUILDINGS QUALIFY?

New construction of a commercial building of any size qualifies for the Energy Policy Act of 2005. New construction of residential rental buildings, such as apartments, qualify if they are four or more stories. Additionally, renovations and retrofits of existing structures are also eligible to receive the deduction. Buildings must be located in the United States.

WHO MAY TAKE THE DEDUCTION?

The deduction is available to the owner of the building at the time it is constructed or when the renovation is made. Generally, the deduction belongs to the entity that is depreciating the energy-efficient property. However, for government-owned buildings, there is a special provision that allows the owner to allocate the deduction to the building’s “designer” (engineer, contractor, architect, environmental consultant, or energy services provider) for the taxable year in which the property is placed in service. This is a very attractive benefit to the building designer because it is essentially “found” money as the government is allocating a tax benefit to parties that provided services and did not incur any building construction costs.

THE BENEFITS OF EPACT 179D

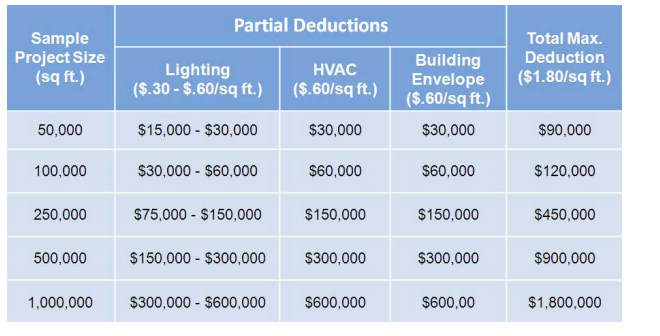

The maximum deduction of $1.80/sq ft. is comprised of three partial deductions: up to $.60/sq ft. for lighting, HVAC, or building envelope each.

Below is a sample of project size and how the Energy Policy Act of 2005 deductions work.

HOW CAN NEW AMERICA POWER HELP?

New America Power provides a turnkey service to help you secure your Section 179D tax incentive. We provide the independent, third-party reports required by the IRS and we do it in a way that reduces the administrative burden on you so you can focus on your business. We perform a complete Section 179D study in accordance with the IRS guidelines including:

Calculation and documentation of the amount of the deduction. Performance of the energy modeling required to certify the project. Delivery of a certification report and the required IRS documentation. Assistance with obtaining the Allocation Letter from the proper government or public entity official. Coordination with your tax advisor or independent accounting firm to ensure that you receive the maximum benefit under the Section 179D incentive program.

We can also assist you with pre-screening potential projects to ensure they qualify for the Energy Policy Act of 2005 incentive.

About New America Power

New America Power (NAP), www.newamericapower.com, a Newtown, Bucks County, based company assists in educating their clients of the ongoing changes and advancements in the energy industry and assist them with making decisions on energy procurement, management and curtailment.

We also provide our clients with many products and services to facilitate entry into the renewable energy

market. We offer a variety of energy products ranging from Fixed-all-inclusive, Index adder, Block and Index, to Wind, Green, Carbon Neutral and more… We work closely with our clients and take advantage of market behaviors that favor our clients’ energy cost. We have special relationships with our energy suppliers to offer future energy purchasing options up to 18 months in advance. This allows businesses currently under contract with another supplier to hedge future purchases and take advantage of the current market’s rates.

As a leading energy consultant, NAP offers a broad array of electricity products and services to fit all of your energy needs:

• Electric and Natural Gas broker

• Utility Bill Auditing

• Sales and financing from installation through maintenance services

• Grant and funding applications

• Energy management and reporting services

• 179D tax incentive

• LED Lighting

NAP will help you Use Less and Spend Less

Lonnie M Barish

41 University Drive

Suite 400

Newtown, Pa 18940

267-968-8651 Cell

267-224-4513 Fax

www.newamericapower.com