Rising COVID cases stemming from the virulent delta variant have driven governments and businesses to reimpose social distancing measures and delay return-to-office policies, putting a damper on some economic activity. But consumers continue to power through the end of the summer.

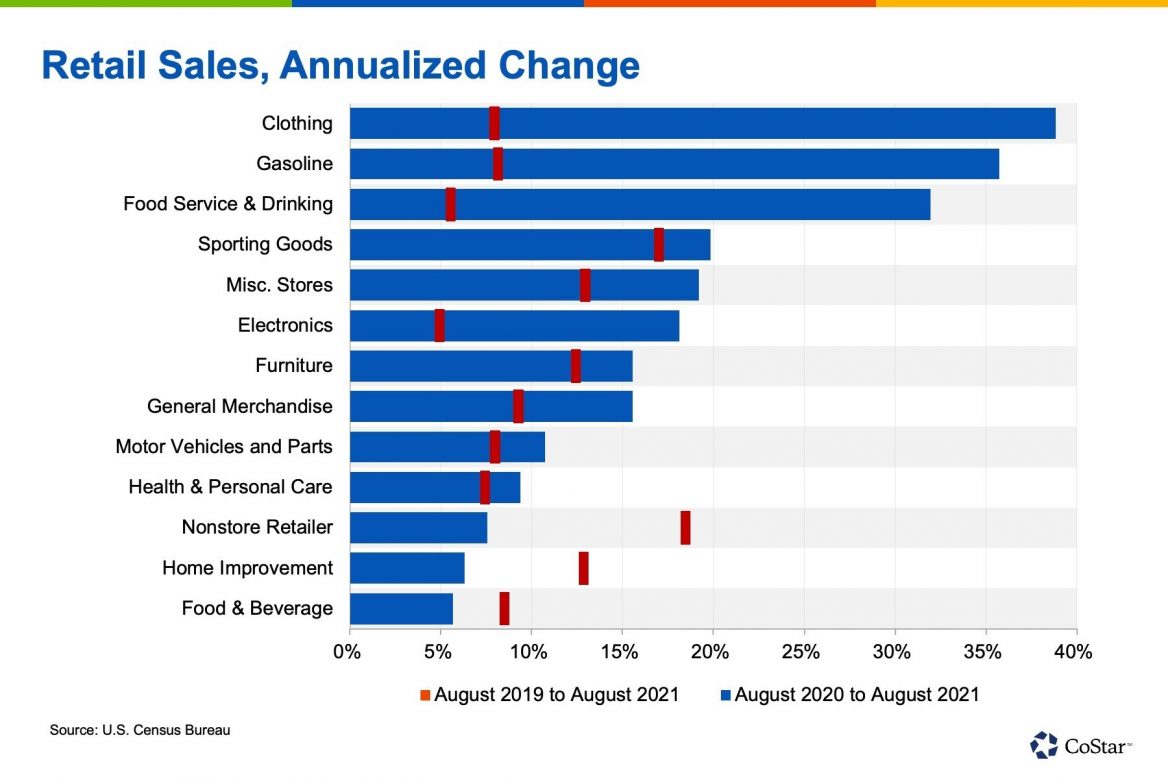

Retail and food services sales unexpectedly grew by 0.7% in August, following a downwardly revised 1.8% fall in July. The month-over-month changes to the headline figure this year have alternated between positive and negative, but at 15.1% year-over-year growth, and at an 9.3% annualized growth since August 2019, it’s evident that retail and food services sales remain elevated, even as COVID cases rise sharply in many parts of the nation.

Clothing sales remained high in August, the prime month for back-to-school shopping. Children and teens outgrew their clothing over the pandemic, and many workers being called back to the office are updating their wardrobes — although athleisure is still experiencing strong gains in sales. Clothing retailers overall are seeing sales at an annualized 7.5% higher than in August 2019.

However, capacity limits and closures deeply affected sales at restaurants and bars, which were flat in August after five consecutive months of growth. The year-over-year increase of 31.9% serves as a reminder of the depth of last year’s pullback when many restrictions were in place. Food services and drinking establishment sales are up an annualized 5.1% since August 2019. Despite these gains, the sector largely underperformed analyst expectations during the summer, as pent-up demand for dining out and travel was thwarted by the ongoing pandemic.

In contrast, sales from nonstore retailers grew by 5.3% in August — leading all major sectors, much like they did regularly in pre-pandemic times. Compared to two years ago, nonstore retailer sales have grown by an annualized 18%, also leading all major sectors.

For more information about New Jersey or Philadelphia health care space, industrial space, retail space, office space, land or other New Jersey and Philadelphia commercial properties, please call 856-857-6300 to speak with Jason Wolf (jason.wolf@wolfcre.com) at Wolf Commercial Real Estate, a leading New Jersey and Philadelphia commercial real estate broker that specializes in both New Jersey and Philadelphia cannabis, healthcare space, office space, retail space, land and New Jersey and Philadelphia industrial space.

Wolf Commercial Real Estate, a full-service CORFAC International brokerage, and advisory firm, is a premier New Jersey and Philadelphia commercial real estate brokerage firm that provides a full range of New Jersey and Philadelphia commercial real estate listings and services, property management services, and marketing commercial offices, medical properties, industrial properties, land properties, retail buildings and other New Jersey and Philadelphia commercial properties for buyers, tenants, investors, and sellers.

A New Jersey and Philadelphia commercial real estate broker with expertise in New Jersey and Philadelphia commercial real estate listings, Wolf Commercial Real Estate provides unparalleled expertise in matching companies and individuals seeking new New Jersey and Philadelphia office space, New Jersey and Philadelphia retail space, or New Jersey and Philadelphia industrial space with the New Jersey and Philadelphia commercial properties that best meets their needs.

As experts in both Philadelphia and New Jersey commercial real estate listings and services, the team at our commercial real estate brokerage firm provides ongoing detailed information about Philadelphia and New Jersey commercial properties to our clients and prospects to help them achieve their real estate goals.

Please visit our websites for a full listing of South Jersey, Philadelphia, and New Jersey commercial properties for lease or sale through our Philadelphia commercial real estate brokerage firm.