In 2021, wind and solar energy continued to replace polluting sources of energy – growing from 11% to 15% (EIA projection for 2022). The Biden administration released a blueprint showing that the price of solar panels will continue to fall and could produce 45% of all US energy by 2050 – enough to power all American homes.

In 2021, wind and solar energy continued to replace polluting sources of energy – growing from 11% to 15% (EIA projection for 2022). The Biden administration released a blueprint showing that the price of solar panels will continue to fall and could produce 45% of all US energy by 2050 – enough to power all American homes.

Despite these tailwinds, the solar industry is emerging from the challenges of the COVID pandemic and is now facing global supply chain shortages. These shortages may cause disruptions in the short-term, but the long-term outlook for solar is still very optimistic.

Download Printable Article (PDF) >>

On a local-level, states are reworking their solar support programs. For example, New Jersey closed out the TREC program on August 28, 2021, and transitioned to a new program that lowers incentives for certain property types (Successor Program or SREC II). Under the new program, solar will no longer support outlandish offers like free rooftops or significant upfront payments. However, there are still many segments where solar can provide strong returns and/or incremental rents.

It is always critical to be proactive and to stay ahead of new federal, state and local programs. When new programs are released, there is often a significant backlog, so that funding and capacity are exhausted in the first few days.

Key market development in solar energy include:

1. New Jersey

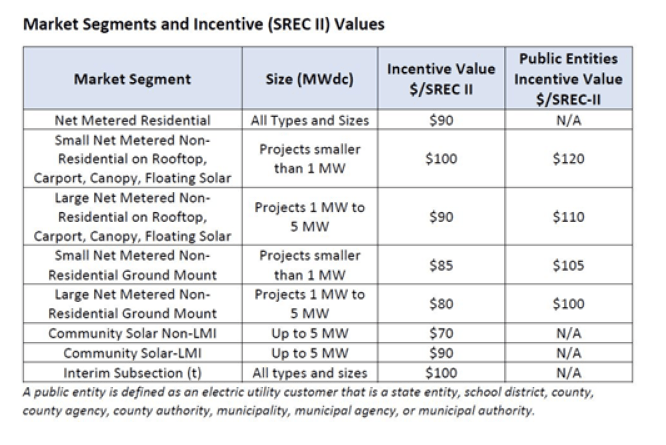

New Jersey transitioned away from the TREC program on August 28, 2021. The new SREC II program offers mostly lower incentives listed below for projects < 5 MW. For larger projects > 5 MW (@ > 500,000 sf rooftops or 15 acres of land), there will be a competitive auction. This new SREC II program will favor lower-cost projects with favorable conditions such as newer rooftops, lower utility interconnection costs, and onsite users with significant electric usage or higher costs of electricity.

In addition, NJ will soon release a new Community Solar program. This will no longer be a pilot program with one-time annual application deadlines, but a program with ongoing, open enrollment. Under the Community Solar program, the solar electricity is interconnected directly to the grid and there is no interaction with the underlying property or tenant. The site acts only as real estate for the solar panels. This program now allows for solar on vacant buildings or where tenants/users do not have large electric usage.

2. Pennsylvania

Pennsylvania is still struggling to adopt legislation that would enable wide-scale adoption of solar energy throughout the state. The SREC value in PA is still level at $40. This pricing allows for certain low-cost solar projects, but is not sufficient to stimulate broad, widespread adoption across all property types and conditions. Two types of bills would create more solar in PA: 1) an increase in demand for SRECs and 2) Community Solar. There are multiple proposals for these bills in various committees, however the solar industry is not optimistic that these bills will be approved soon. Despite bipartisan support, legislative leaders in Harrisburg are holding back support for clean energy. In the interim, over 15,000 MW of projects (over $20 billion) have petitioned for utility approval in PA. This represents a significant backlog. If enabling solar legislation were enacted in PA in the future, there would already be a sufficient supply of backlogged projects to meet new state targets. Possibly, it would be too late to start on new, incremental projects. In the immediate-term, there are presently opportunities for projects where electric prices are high, specifically in PECO territory.

3. Federal Policy: Infrastructure Bill Soon

The Biden administration announced that carbon emissions could be sharply reduced by increasing solar’s share of the grid from 4% to 45%. This 2050 goal is outlined in a road map from the Department of Energy. In addition, the proposed infrastructure bill contains provisions for clean energy, specifically solar. At this time, these provisions are being heavily negotiated and are uncertain. However, the most recent version does include an increase of the federal tax credit for solar – from 26% to 30% of the project cost.

This tax credit would be established for 5-10 years. There may be certain requirements to obtain the 30% level including US-manufactured solar panels or prevailing wage labor requirements. At the federal level, we anticipate more support for solar. These federal supports may offset any reductions in the state level, such as the NJ SREC II program shown above. The critical take-away is that sweeping generalizations about solar energy no longer hold. Every property type, geographic region, and financing structure is different, and it is critical to stay ahead of emerging, new programs before they are released.

Independence Solar

Keith Peltzman is president and founder of Independence Solar with offices in Cherry Hill, NJ and Boston, MA. Independence Solar is a turnkey developer and installer of commercial solar energy. Since 2007, our team has developed and built 60MW of solar projects valued at $250 million, including one of the top ten largest rooftop solar arrays in the U.S (10.1 MW). Independence Solar forges long-term partnerships with our clients by offering the complete suite of solar services–development, financing, installation, and ongoing maintenance. We operate multiple offices in NJ, CT, MA, and PA to better service our clients’ projects.