The U.S. has maintained a 2.5 million vaccine dose per day average for the past two weeks, and the benefits have become immediately apparent. Every state has vaccinated at least 25% of its population, with many states likely to pass 50% in the next few weeks.

As the virus goes, so goes the economy, and the Census Bureau’s Household Pulse Survey shows just how immediate these benefits have been. Compared to

the end of 2020, a staggering 13 million fewer people have noted loss of employment income compared to pre-recession. (Note: This is a broader phrasing than “Are you working?”, hence being much higher than job growth figures.)

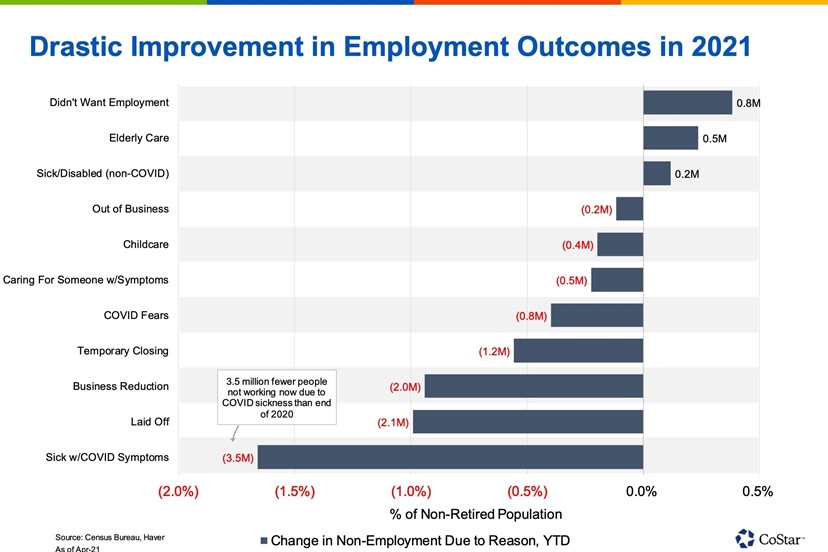

The single most significant driver of this improvement comes from those out of work due to COVID symptoms. When combined with those not working due to COVID fears, or because they are caring for someone with COVID symptoms, there are 5 million fewer noting loss of employment income than at year-end 2020.

The improvement has been incredibly broad, with 2 million fewer out of work due to layoffs, another 2 million fewer out due to reduced business and over a million fewer who lost income due to temporary closings.

It is also worth noting that much of this improvement came at the end of March: As of March 30, 7.2% of the nonretired population had lost employment income due to business changes (i.e., poor business conditions), a major decline from 8.6% only

two weeks prior. We think there’s no coincidence this improvement happened right as vaccinations were aggressively picking up pace.

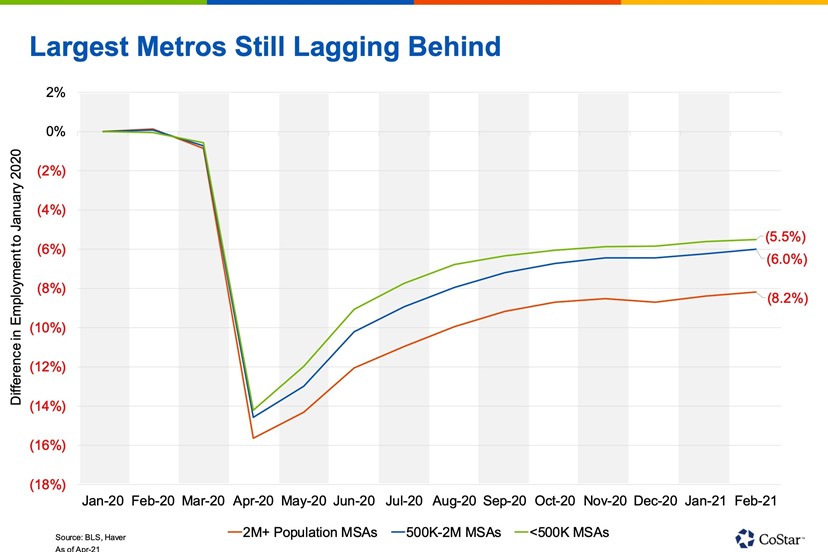

One aspect we’ll be watching closely as these trends continue is the relative outcomes for the largest cities compared to more suburban or rural areas. The pandemic hit the densest areas the hardest, most notably New York City, San Francisco, and Los Angeles. In data released last week by the Bureau of Labor Statistics, in February 2021, these three cities — in addition to entertainment and hospitality-heavy Las Vegas — still showed employment over 11% lower than pre-pandemic levels.

As seen in the chart above, these largest cities slowed the most in the fall and winter of 2020, but have caught up somewhat since.

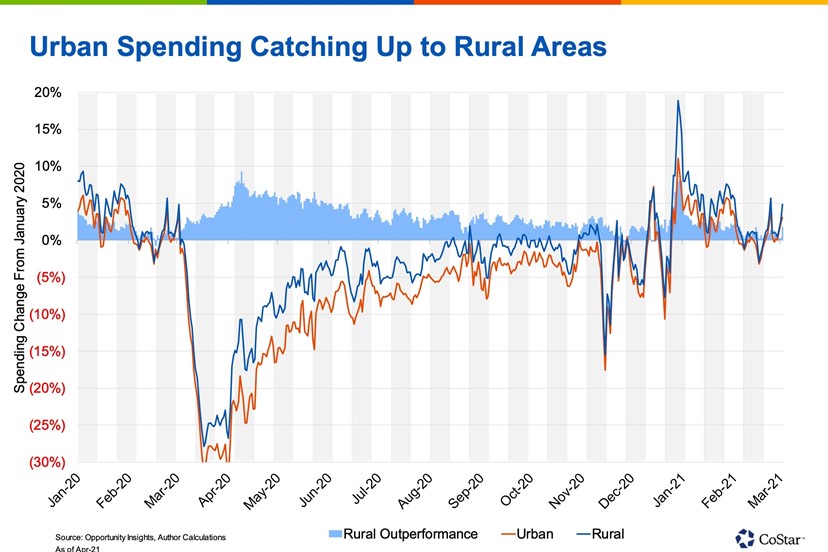

Looking to higher-frequency data for more clues, we see the urban-suburban gap narrowing even more rapidly in early February and into March. The chart below shows spending changes for majority urban and majority rural counties compared to January 2020. In the early pandemic months, the difference spiked to over 5%, but slowly narrowed for most of the year. This suddenly reversed to close 2020, as seen in the graph above, as COVID cases spiked again. But as of March, the difference between the two series is negligible.

If there’s pent-up demand in the economy right now, it is in these major cities, and is likely to become a prominent part of the story over the next few months.

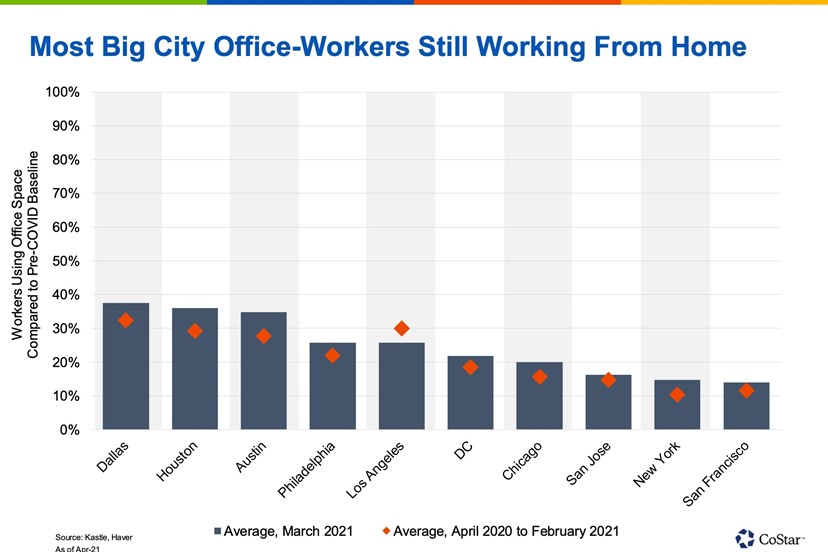

The next shoes to drop, so to speak, involve decisions to fully return to pre-pandemic daily habits. The question we hear most often relates to office usage and when things will go back to normal, or what a new normal might look like. Looking to the data, the increased pace of vaccinations has not lead to a meaningful return to regular office usage as of March.

According to data from Kastle Systems, across 10 major office-using cities, only 1 of every 4 employees is back in the office. In New York and San Francisco, it’s only 1 of every 7.

Last week’s comments from JP Morgan CEO Jamie Dimon are the latest hint that office use will be different from before the pandemic. Some companies will follow JP Morgan’s lead and cut office space by 40%, others may cut more and some may not change their office footprint at all. While many companies seem to enjoy the benefits of remote work, and the smaller rent bill, we also wonder how these soundbites will evolve as the majority of the population becomes vaccinated and other behaviors, such as public transit usage, return to normal.

Our hunch is that the cities with the longest commutes and the most expensive office space will be the slowest to recover. So far, the data bears that out. But the next few months of economic data should be very strong, and attitudes can change. Decisions made during the fog of a global pandemic may seem too extreme when that fog lifts. And make no mistake, that fog is slowly lifting.

The Week Ahead …

Next week is highlighted by retail sales and industrial production data for March. We discussed the divergence between the two series last month, when strong consumption while factory production remains limited has meant delays in delivery times, and likely some temporary inflation. We expect this trend to continue in March, as new stimulus checks hit household accounts and the late March Suez Canal blockage slowed global deliveries even more.

While not as exciting on the surface, consumer price index data for March is set to be released on Tuesday and should exhibit how these dynamics have been playing out so far in 2021. The noise-to-signal ratio will be high on this one, and we’re looking forward to sorting through it as inflation remains the bugaboo du jour for many macro commentators.

*Article courtesy of CoStar

For more information about New Jersey or Philadelphia industrial space, New Jersey or Philadelphia retail space, and New Jersey or Philadelphia office space or other New Jersey and Philadelphia commercial properties, please call 856-857-6300 to speak with Jason Wolf (jason.wolf@wolfcre.com) at Wolf Commercial Real Estate, a leading New Jersey and Philadelphia commercial real estate broker that specializes in both New Jersey and Philadelphia office space, New Jersey and Philadelphia retail space, and New Jersey and Philadelphia industrial space.

Wolf Commercial Real Estate, a full-service CORFAC International brokerage, and advisory firm, is a premier New Jersey and Philadelphia commercial real estate brokerage firm that provides a full range of New Jersey and Philadelphia commercial real estate listings and services, property management services, and marketing commercial offices, medical properties, industrial properties, land properties, retail buildings and other New Jersey and Philadelphia commercial properties for buyers, tenants, investors, and sellers.

A New Jersey and Philadelphia commercial real estate broker with expertise in New Jersey and Philadelphia commercial real estate listings, Wolf Commercial Real Estate provides unparalleled expertise in matching companies and individuals seeking new New Jersey and Philadelphia office space, New Jersey and Philadelphia retail space, or New Jersey and Philadelphia industrial space with the New Jersey and Philadelphia commercial properties that best meets their needs.

As experts in both Philadelphia and New Jersey commercial real estate listings and services, the team at our commercial real estate brokerage firm provides ongoing detailed information about Philadelphia and New Jersey commercial properties to our clients and prospects to help them achieve their real estate goals. If you are looking for New Jersey or Philadelphia office space, Philadelphia or New Jersey retail space, or New Jersey or Philadelphia industrial space for sale or lease, Wolf Commercial Real Estate is the New Jersey and Philadelphia commercial real estate broker you need – a strategic partner who is fully invested in your long-term growth and success.

Please visit our websites for a full listing of South Jersey, Philadelphia, and New Jersey commercial properties for lease or sale through our Philadelphia commercial real estate brokerage firm.