New Jersey Economic Opportunity Act Of 2013 (PDF)

The Grow New Jersey Assistance Program (Grow NJ) and the Economic Redevelopment and Growth Program (ERG)

By: New Jersey Economic Develoment Authority MAY 23, 2014

SUMMARY

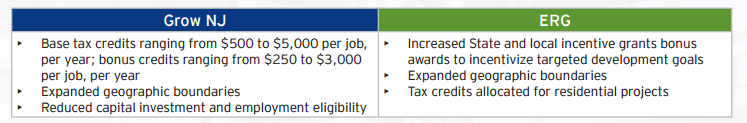

• The New Jersey Economic Opportunity Act of 2013 merges the State’s economic development incentive programs with the goal of enhancing business attraction, retention and job creation efforts and strengthening New Jersey’s competitive edge in the global economy.

• The Grow New Jersey Assistance Program (Grow NJ) is now the main job creation incentive program and the Economic Redevelopment and Growth Program (ERG) is the State’s key developer incentive program. Both programs have been expanded and will sunset July 1, 2019.

The Act also extends application deadlines for support through the Public-Private Partnership (P3) Program and Offshore Wind Economic Development Program.

GROW NJ – AREAS OF ELIGILIBILITY

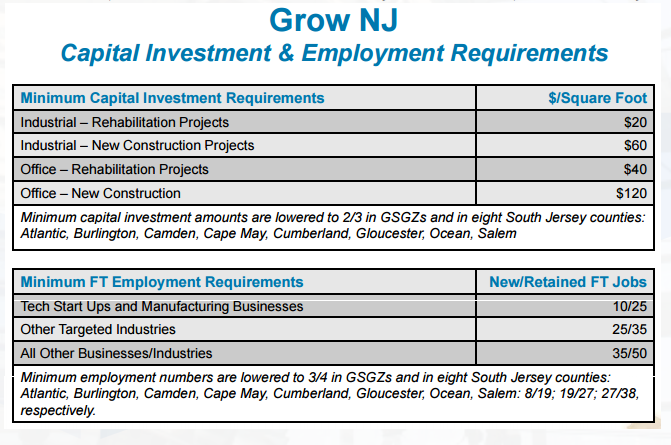

MEGA PROJECTS

• Logistics, manufacturing, energy, defense, or maritime businesses in a port district or businesses in the aviation industry located in an aviation district with: 1) cap. investment of $20 million+ and 250 jobs created or retained; or, 2) 1,000 jobs created or retained.

• Businesses located in an Urban Transit Hub with cap. investment of $50 million+ and 250 jobs created or retained.

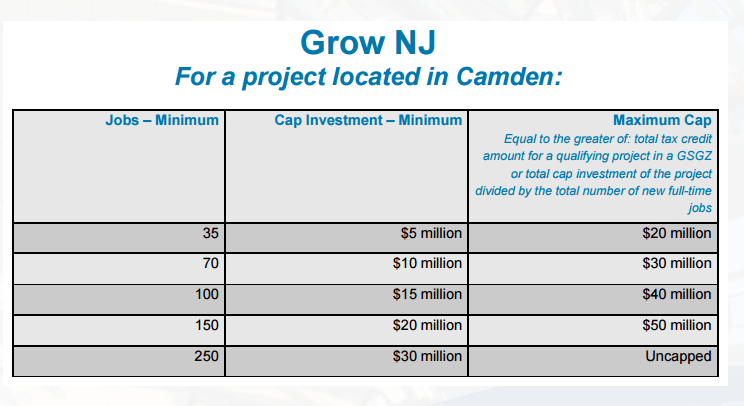

GARDEN STATE GROWTH ZONES (GSGZ)

• Camden, Trenton, Paterson and Passaic – the New Jersey cities with the lowest median family income based on the 2009 American Community Survey from the US Census

DISTRESSED MUNICIPALITIES

• A municipality that is qualified to receive assistance under the Municipal Urban Aid Program; is under the supervision of the Local Finance Board; identified by DCA to be facing serious fiscal distress; a SDA municipality; or a municipality boasting a major rail station.

PRIORITY AREAS

• Planning Area 1 (Metropolitan), Planning Area 2 (Suburban), a designated center under the State Development and Redevelopment Plan or a designated growth center in an endorsed plan’

• Areas that intersect with portions of: a deep poverty pocket, a port district, or federally owned land approved for closure under a federal Base Realignment Closing Commission action;

• Proposed site of a disaster recovery project, a qualified incubator facility, a highlands development credit receiving area or redevelopment area, a tourism destination project, or transit oriented development;

• Areas that contain a vacant commercial building having over 400,000 s.f. of office, lab, or industrial space available for occupancy for a period of over one year; or a site that has been negatively impacted by the approval of a Hub-supported project.

OTHER ELIGIBLE AREAS

• Areas not located within a distressed municipality or priority area, including an Aviation District; Planning Area 3; certain portions of Meadowlands, Pinelands and Highlands; and certain portions of Planning Areas

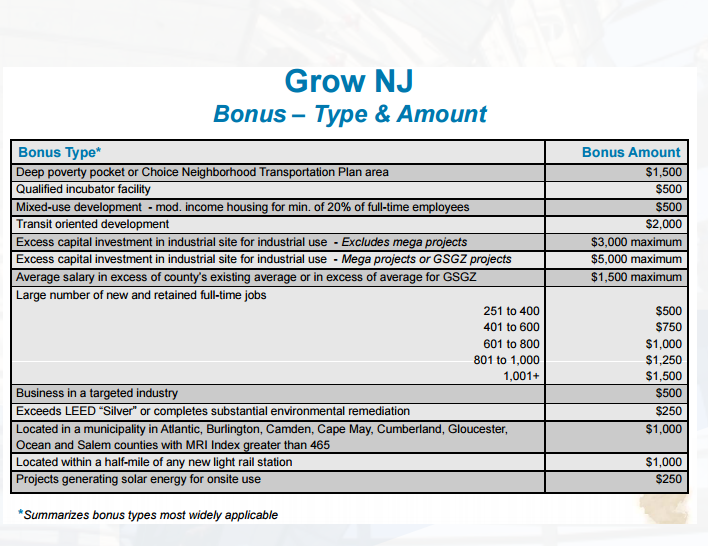

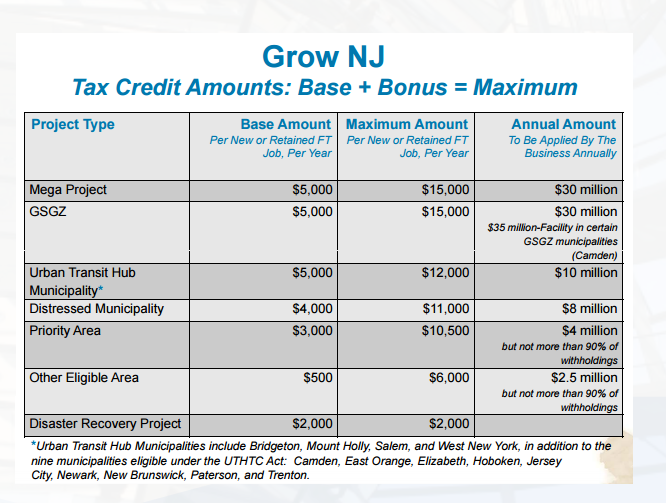

GROW NJ FINAL TOTAL TAX CREDIT AMOUNT

Each new full-time job = 100% tax credit

Each retained full-time job = 50% tax credit*

• All projects are subject to a comprehensive net benefit analysis to verify that the revenues the State receives will be greater than the incentive being provided.

• For projects approved for $40 million or more over the term ($4 million annually), the EDA will award only funds necessary to complete a project or the amount permitted under the statute, whichever is less.

ERG INCENTIVE AMOUNTS

State and Local Incentive Grants

• The Act authorizes a bonus of 10% in certain cases, up to a maximum of 30% of total project costs; 40% for projects in a GSGZ.

• For Local Incentive Grants, up to a maximum of 100% if the developer is a municipal government or redevelopment agency

• All projects are subject to a comprehensive net benefit analysis to verify that the revenues the State receives will be greater than the incentive being provided.

ERG BONUS AWARDS

Bonus of up to 10% if project is:

• Located in a distressed municipality:

• lacking access to nutritious food, and will include a supermarket or grocery store (min. of 15,000 sq ft of space) selling fresh products or a prepared food establishment selling nutritious, ready to serve meals; or,

• lacking access to health care and health services, and will include a health center (min. of 10,000 sq ft of space) devoted to providing these services

• Transit project

• Qualified residential project with at least 10% of units constructed as and reserved for moderate income housing

• Located in a highlands development credit receiving area or redevelopment area

• Located in a GSGZ

• Disaster recovery project

• Aviation project

• Tourism destination project

• Substantial rehabilitation or renovation of an existing structure(s)

ERG QUALIFIED RESIDENTIAL PROJECTS

Of the $600 million authorized for qualified residential projects*:

• $250 million for projects within Atlantic, Burlington, Camden, Cape May, Cumberland, Gloucester, Ocean and Salem counties, of which:

• $175 million for projects in Camden

• $75 million for projects in municipalities with a 2007 MRI Index of 400 or higher

• $250 million for qualified residential projects located in:

• Urban Transit Hubs that are commuter rail in nature

• ?A Garden State Growth Zone

• Disaster recovery projects

• SDA municipalities located in Hudson County that were awarded State Aid in FY 2013 through the

Transitional Aid to Localities Program

• $75 million for projects in distressed municipalities, deep poverty pockets, highlands development credit receiving areas or redevelopment areas.

• $25 million for projects located within a qualifying ERG incentive area.

*The Act does not change the existing requirement that residential projects receiving an ERG must dedicate 20% of a project to low and moderate income housing

BEIP, BRRAG & UTHTC

EDA is no longer accepting applications for assistance under the

• Business Employment Incentive Program (BEIP), Business Retention and Relocation Assistance Grant

Program (BRRAG), and Urban Transit Hub Tax Credit Program (UTHTC).

• All pending BEIP and BRRAG applications will be acted on by December 31, 2013.

All non-residential, pending UTHTC applications will be acted on by December 31, 2013. Residential

applications submitted under the December 2012 competitive solicitation will be acted on within 120 days of the Act’s September 18, 2013 effective date.

• Businesses that had submitted an application under Grow NJ or ERG before enactment can amend the application to receive more favorable terms under the provisions of the revised programs.

GROW NJ AND ERG NEW APPLICATION DEADLINES

• Grow NJ applications must be filed by July 1, 2019.

• Businesses must submit documentation indicating it has met agreed upon capital investment and

employment requirements within three years of EDA approval.

• EDA can grant two, 6-month extensions.

• ERG applications must be filed by July 1, 2019.

• Applications for a qualified residential project must be filed by July 1, 2015, and the developer must

obtain a temporary certificate of occupancy for the project no later than July 28, 2015.

• EDA anticipates launching the new programs in November 2013.

Summary

• The New Jersey Economic Opportunity Act of 2013 merges the State’s economic development incentive programs with the goal of enhancing business attraction, retention and job creation efforts and strengthening New Jersey’s competitive edge in the global economy.

• The Grow New Jersey A it ss s ance Program (Grow NJ) is now the main job creation incentive program and the Economic Redevelopment and Growth Program (ERG) is the State’s key developer incentive program. Both programs have been expanded and will sunset July 1, 2019.