Suppose that a company’s income statements show that the business lost money — but you know the company is successful and providing a good lifestyle for the owner. How can this be? Do you do like everyone else and just push it off to Covid related? The reported earnings may just need to be normalized. Among the first and most important steps in the valuation of a business is making adjustments to the income statements — from G.A.A.P. (Generally Accepted Accounting Principles not necessarily Generally Accepted Abo Principles) or Tax Based Accounting reported earnings to normalized, or adjusted, earnings. Normalized earnings are generally used as the basis for analyzing a company’s earning performance and to compare that performance to other companies in the industry.

Suppose that a company’s income statements show that the business lost money — but you know the company is successful and providing a good lifestyle for the owner. How can this be? Do you do like everyone else and just push it off to Covid related? The reported earnings may just need to be normalized. Among the first and most important steps in the valuation of a business is making adjustments to the income statements — from G.A.A.P. (Generally Accepted Accounting Principles not necessarily Generally Accepted Abo Principles) or Tax Based Accounting reported earnings to normalized, or adjusted, earnings. Normalized earnings are generally used as the basis for analyzing a company’s earning performance and to compare that performance to other companies in the industry.

Download Printable Article (PDF) >>>

To further illustrate, here’s a discussion on point from a recent Abo Cipolla Financial Forensics appraisal we just completed. “Normalization adjustments must adjust the historical financial income statements so they represent a normal condition as of the valuation date. Nearly every valuation requires tax return or financial statement normalizations (adjustments) that result in an impact on the valuation techniques considered and applied. Such normalizations are typically financial transactions of a non-recurring, nonoperating, or non-market nature. They are adjustments to the financials for items not representative of the present going concern status of the business. The ultimate goal of the adjustments is to accurately reflect the entity’s financial position as of the valuation date and its “normal” results of operations for the periods being analyzed. The goal is not to “correct” the financial income statements. Rather, it is to present them as an outside investor would look at the entity.

A Case Study To Illustrate Adjusting Income Statements: Cuse’s Machines

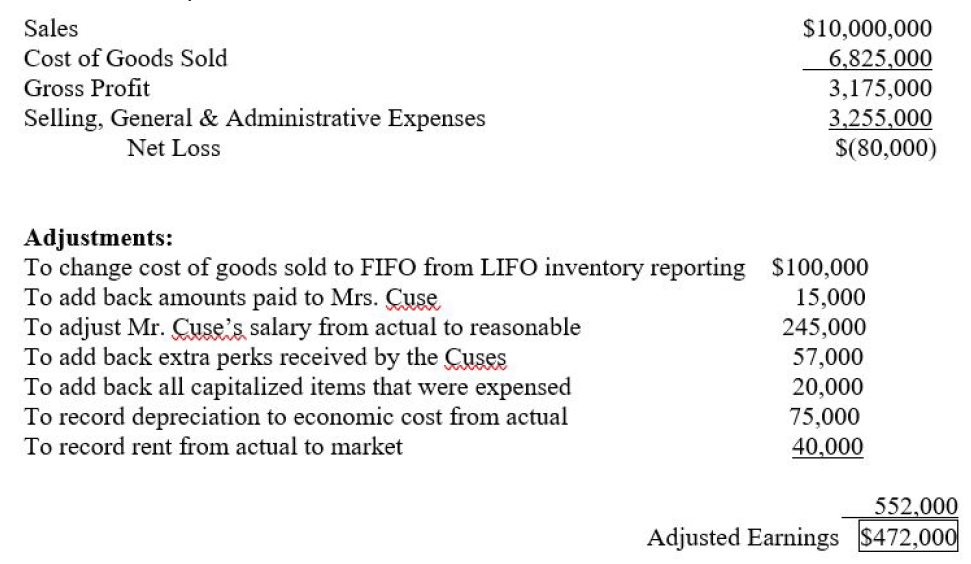

For valuation purposes, reported income may require several adjustments to determine the appropriate earnings. While some of the adjustments are clear-cut, others require an expert’s judgment as to whether they should be made and, if so, in what amount. For instance, Cuse’s Machines manufactures equipment. During the initial document request phase, we as the valuator learn that on its 2020 financial statement the company reported an $80,000 loss. During the discovery phase, this expert learns:

• The company uses the last-in, first-out (LIFO) method to value its inventory. Its LIFO reserve was $400,000 at the beginning of the year and $500,000 at the end of the year.

• Payments of $15,000 to Mrs. Cuse for “bookkeeping” services are included in office salaries when, in fact, she did not prepare any books or records for the company.

• The company has paid Mr. Cuse a significant bonus each year, primarily to pay out all of the income and to reduce the company’s tax obligation.

• Mr. and Mrs. Cuse received extra benefits, including profit sharing ($28,000) and travel and entertainment ($12,000).

• The company has a policy of expensing all repair and maintenance items under $2,500. Individual invoices for furniture and equipment totaled $20,000.

• The estimated economic useful lives of the property and equipment are longer than the tax lives used for depreciation.

• The company entered into a lease Jan. 1, 2020, with the sole shareholder, Mr. Cuse, for its office and warehouse (20,000 square feet total) at a rate of $2/ft. above the market rate.

As the table shows, several adjustments were needed to obtain a more accurate picture of the company’s earnings. However, forensic accounting techniques involve more in-depth analysis and are generally handled under a separate engagement from the routine “accounting and tax” services. Perhaps any business owner can use some help in understanding adjustments to income statements and their implications for a business. Just sayin’!

FOR MORE INFORMATION:

Martin H. Abo, CPA/ABV/CVA/CFF is a principle of Abo and Company, LLC and its affiliate, Abo Cipolla Financial Forensics, LLC, Certified Public Accountants – Litigation and Forensic Accountants. With offices in Mount Laurel, NJ and Morrisville, PA, tips like the above can also be accessed by going to the firm’s website at www.aboandcompany.com.

Martin H. Abo, CPA/ABV/CVA/CFF

307 Fellowship Road, Suite 202

Mt. Laurel, NJ 08054

(856) 222-4723

marty@aboandcompany.com

For more information VISIT: https://www.aboandcompany.com/