Confusion abounds, especially during this crazy time and dealing with the well-intentioned government funding relief. My friends, mistakes happen. Fortunately, this time it’s not us at Abo and Company but one of our respected payroll providers, Paychex (we even use and will continue to use them).

Confusion abounds, especially during this crazy time and dealing with the well-intentioned government funding relief. My friends, mistakes happen. Fortunately, this time it’s not us at Abo and Company but one of our respected payroll providers, Paychex (we even use and will continue to use them).

We reported in our earlier email alert that the CARES (Coronavirus Aid, Relief and Economic Security) Act enables employers (including self-employed individuals) with less than 500 employees to participate in an 8-week loan program for up to 250% of the monthly payroll brought about by the economic uncertainty as long as they maintain their payroll during this COVID-19 emergency. This loan under the PPP (Payroll Protection Plan) is a no brainer and we believe all businesses should apply since much or all of it may ultimately be FORGIVEN.

Simply put, the PPP calls for providing the SBA through your bank an average monthly payroll plus certain employer paid benefits such as health insurance, retirement contributions and state/local taxes.

Abo and Company has been advising clients, friends of the firm and even many of our CPA colleagues during the last two weeks that, even though an employer pays for mandated benefits like the matching Social Security and Medicare tax, such federal benefit costs are EXCLUDED from the PPP’s computations.

In their well-intentioned rush to get valuable information to their customers and professional advisors like us, Paychex inadvertently provided inaccurate Q & A and illustrations.

Here’s the INCORRECT information:

Q. How do you calculate average monthly payroll for PPP loan application?

A: For the calculation of the Average Monthly Payroll cost, we recommend that payroll providers and CPAs use Gross Payroll based on 2019 data…..

Specifically:

Gross wages plus ER State/Local Tax Assessed plus ER FICA…” (note per Abo

that ER refers to the employer portion).

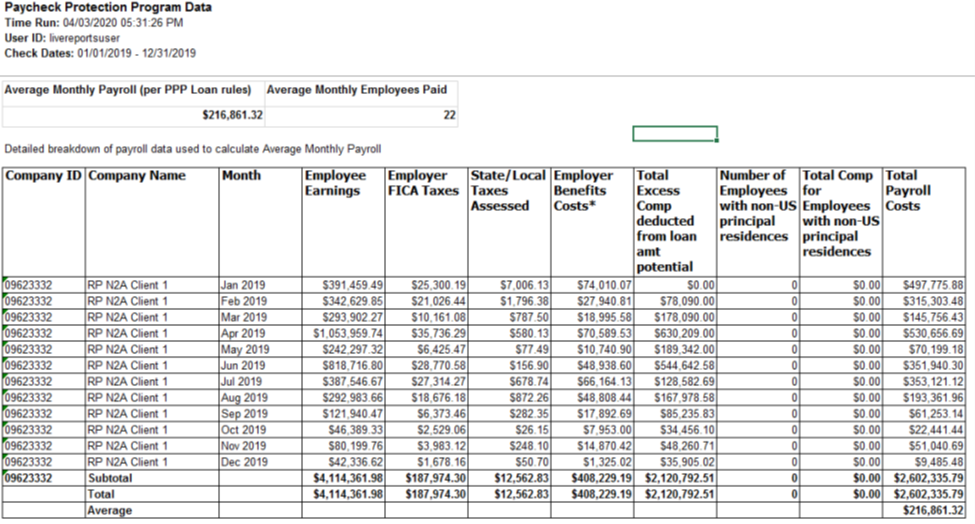

And here’s the very helpful chart Paychex provided (except we think they should eliminate column 5).

For anal tax techies like us, here’s what we gleaned from the actual SBA’s Interim Final Rule issued last week that we relied upon and why we alerted Paychex:

Q. Is there anything that is expressly excluded from the definition of payroll costs?

A. Yes. The Act expressly excludes the following… Federal employment taxes imposed or withheld between February 15, 2020 and June 30, 2020, including the employee’s and employer’s share of FICA…

Late last night the U.S. Treasury and the SBA released Frequently Asked Questions (FAQs) on the PPP that also stated borrowers and lenders may rely on. Among the clarifying points was that the employer’s share of FICA and Medicare taxes should NOT be included.

As an aside, last night’s FAQs also confirmed what we at Abo and Company have been telling clients that the $100,000 salary limitation does not include health care, retirement benefits, and state and local taxes and that those using Professional Employer Organizations (PEOs) can provide payroll reports since they cannot produce individual entity payroll tax documents.

Paychex has informed us they are making the appropriate changes to some of the materials they disseminated. They commented that the SBA has provided a Safe Harbor for any borrower who has already applied for the loan or had a loan approved prior to the revised guideline and that borrowers who have applied for a loan on or before April 6th do not need to make a further application.

Marty Abo, Abo and Company

307 Fellowship Road – Suite 202,

Mt. Laurel, NJ 08054

Phone: 856-222-4723