Wolf Commercial Real Estate

Tips For Those Who Pay Or Should Pay Estimated Taxes

Depending on what you do for a living and what your spouse may be earning, you may have income that is not subject to withholding. It’s possible that you may […]

Read More....What is a Commercial Relocation Concierge?

What is a commercial relocation concierge, and do they really add value to your project? Let’s get one thing out of the way right up front: a commercial relocation concierge […]

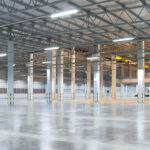

Read More....Costs to develop, lease industrial keep soaring as demand for warehouses remains historically high

It’s now more expensive than ever to source, build and rent warehouse space — but that hasn’t tempered demand. The market has reached a point where industrial landlords are sometimes […]

Read More....Why Companies Aren’t Cutting Back on Office Space

In our monthly surveys of 5,000 American workers and 500 U.S. employers, and in our numerous conversations with managers, a huge shift to hybrid work is abundantly clear for office and […]

Read More....Commercial Real-Estate Sales and Values Surge to Records

Investors purchased a record amount of commercial real estate in the third quarter, defying warnings that the Covid-19 pandemic would erode these property values and starve the industry of cash. […]

Read More....Resilient Consumers Keep Spending

Rising COVID cases stemming from the virulent delta variant have driven governments and businesses to reimpose social distancing measures and delay return-to-office policies, putting a damper on some economic activity. […]

Read More....Many employees want to work remotely forever. Some business owners will fire those who try.

Many small business owners want their employees to return to the office full-time as the pandemic wanes — and 39% said they would fire workers who refuse. That is from […]

Read More....Cannabis Sales Go Suburban as Large, Open Air Shopping Centers Become Fertile Retail Ground

A Grupo Flor store that just opened in Union City, California, is billed as the nation’s first cannabis business in a type of regional, open-air shopping center that’s normally home to big-box […]

Read More....The Future of Office Work has Arrived

Effective 6 AM on June 4, 2021, employers had the green light to require their employees to return to the office. Gov. Phil Murphy’s Executive Order No. 243 rescinds the […]

Read More....Residential Developers Get Go-Ahead To Apply for New Jersey Tax Incentives

After a two-year halt, residential real estate developers in New Jersey can now apply for state tax incentives from $50 million set aside as part of legislation Gov. Phil Murphy […]

Read More....Sheetz Becomes First Convenience Store Chain to Accept Cryptocurrency

Sheetz, the Pennsylvania-based convenience store chain, has announced it will enable digital currency payments to provide customers with the ability to pay for items inside the store and at the […]

Read More....Target To Accelerate Real Estate Expansion Plans Amid Sales Growth

Target Corp. said it is planning to keep its strong sales momentum going by upping the ante on building out its logistics network over the next 24 months. The retailer, […]

Read More....