Commercial Mortgage Backed Securities (CMBS): Then and Now (PDF)

by Tim Deegan, Director, Capital Markets, Llenrock Group

Commercial Mortgage Backed Securities or CMBS may not be the most glamorous side of commercial real estate, but it’s arguably one of the most influential factors in deal activity. Since 2008-09, the commercial real estate industry has seen a lot of controversy and handwringing around the subject of CMBS, the conduit-based asset-backed securities that played such a pivotal role in pre-recession deals. To be sure, the global economic crisis dried up lending across market and asset type, whether we’re talking about securitized debt or balance sheet lending. But the reasons for bearishness in the capital markets, both at the time and in subsequent years, aren’t simply the volatility of the global economy and poor real estate fundamentals.

Commercial Mortgage Backed Securities or CMBS may not be the most glamorous side of commercial real estate, but it’s arguably one of the most influential factors in deal activity. Since 2008-09, the commercial real estate industry has seen a lot of controversy and handwringing around the subject of CMBS, the conduit-based asset-backed securities that played such a pivotal role in pre-recession deals. To be sure, the global economic crisis dried up lending across market and asset type, whether we’re talking about securitized debt or balance sheet lending. But the reasons for bearishness in the capital markets, both at the time and in subsequent years, aren’t simply the volatility of the global economy and poor real estate fundamentals.

During the recession and early recovery, three issues have emerged to complicate CMBS lending–and real estate deal-making in general.

These issues are:

• Pre-recession 5-, 7-, and 10- year Commercial Mortgage Backed Securities debt coming due in the colder post-recession market has made refinancing difficult for some, though in 2015 this dynamic is working itself out for both borrowers and lenders thanks to improved fundamentals.

• Bond-rating and the agencies responsible for this practice have taken a lot of heat for their role in the real estate downturn with critics citing conflicts of interest and institutional pressures as particular challenges to accurate ratings.

• Finally, and this is what we’re talking about today, underwriters and policymakers alike have recognized the need for greater diligence and more strict underwriting to protect both the investors who buy these bonds and the borrowers themselves.

While we have seen cap rates decrease substantially and deal activity increase in the last few years, the conditions of the market today and the mindset of potential buyers do not match the same conditions we saw a decade ago.

Before the downturn, speculators would borrow with the hopes that rising market values would outpace costs. What could possibly go wrong?

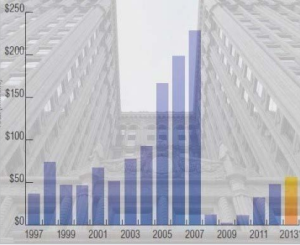

A lot of things, it turns out. Still feeling the sting of the financial crisis and its spate of defaults, today’s buyers tend to be more conservative. But as 2015 shapes up to be the biggest year for CMBS issuance since the downturn, underwriting standards are reportedly relaxing to a great extent.

How do we avoid reverting to the sloppy underwriting that contributed to the real estate crisis and its defaults?

Our friends from the SEC have some thoughts on the subject.

Last year, the Securities and Exchange Commission issued provisions calling for significant changes in securities issuance and reporting requirements. The goal of these changes was to restore faith to investors and accountability from CMBS lenders. The intent of circulating Regulation AB was to add additional safeguards beyond reliance on private ratings.

Among these provisions is the requirement that the lending institution’s CEO signs a certification that he or she has reviewed the prospectus and is familiar with the securitized asset, material transaction document and structure. Ultimately, this will urge executives to more closely scrutinize their lending and CMBS issuance.

Since the SEC’s Reg AB updates are only a year old, the jury is still out on whether or not this will curb CMBS lending or limit this lending option to only “slam-dunk” property deals.

While CMBS may be a desirable and modestly affordable capital source for many deals, this market is far from the capital free-for-all of yesteryear. As you work to fundraise your next acquisition, development, or refinancing, bear in mind that CMBS is just one of many options available in today’s capital markets, and it isn’t always appropriate for every deal.

Llenrock Group is a real estate capital advisory firm in Center City, Philadelphia. We feature a talented team of advisors with decades of experience negotiating, structuring, and securing commercial real estate.

For more information, contact:

Tim Deegan

Director, Capital Markets

Llenrock Group

P 215.501.7017

www.llenrock.com